On November 13, 2025, the Internal Revenue Service (IRS) released Notice 2025-67, which sets forth the 2026 cost-of-living adjustments affecting dollar limits on benefits and contributions for qualified retirement plans. The IRS also announced the health savings account (HSA) and high deductible health plan (HDHP) annual deductible and out-of-pocket expense adjustments earlier this year in Revenue Procedure 2025-19 and the health flexible spending arrangement (Medical FSA) adjustments in Revenue Procedure 2025-32. Finally, the Social Security Administration announced its cost-of-living adjustments for 2026 on October 24, 2025, which includes a change to the taxable wage base.

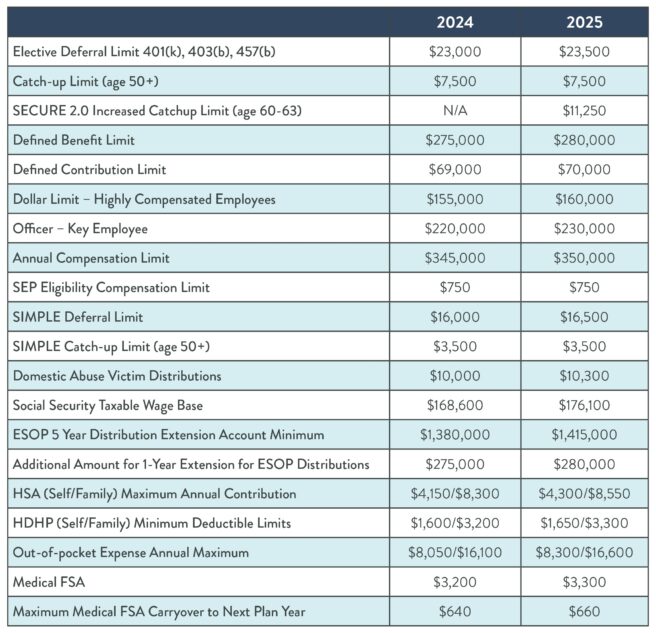

The following chart summarizes the 2026 limits for benefit plans. The 2025 limits are provided for reference.

| 2025 | 2026 | |

| Elective Deferral Limit 401(k), 403(b), 457(b) | $23,500 | $24,500 |

| Catch-up Limit (age 50+) | $7,500 | $8,000 |

| SECURE 2.0 Increased Catch-up Limit (age 60-63) | $11,250 | $11,250 |

| Roth Catch-up Wage Threshold | N/A | $150,000 |

| Defined Benefit Limit | $280,000 | $290,000 |

| Defined Contribution Limit | $70,000 | $72,000 |

| Highly Compensated Employee Threshold | $160,000 | $160,000 |

| Key Employee/Officer Threshold | $230,000 | $235,000 |

| Annual Compensation Limit | $350,000 | $360,000 |

| Domestic Abuse Victim Distribution Maximum | $10,300 | $10,500 |

| SEP Eligibility Compensation Limit | $750 | $800 |

| SIMPLE Deferral Limit | $16,500 | $17,000 |

| SIMPLE Catch-up Limit (age 50+) | $3,500 | $4,000 |

| SECURE 2.0 SIMPLE Increased Catch-up Limit | $5,250 | $5,250 |

| Social Security Taxable Wage Base | $176,100 | $184,500 |

| ESOP 5 Year Distribution Extension Account Minimum | $1,415,000 | $1,455,000 |

| Additional Amount for 1-Year Extension for ESOP Distributions | $280,000 | $290,000 |

| HSA (Self/Family) Maximum Annual Contribution | $4,300/$8,550 | $4,400/$8,750 |

| HDHP (Self/Family) Minimum Deductible Limits | $1,650/$3,300 | $1,700/$3,400 |

| HDHP Out-of-pocket Expense Annual Maximum | $8,300/$16,600 | $8,500/$17,000 |

| Medical FSA Maximum Annual Contribution | $3,300 | $3,400 |

| Maximum Medical FSA Carryover to Next Plan Year | $660 | $680 |

For more information on the 2026 cost-of-living adjustments, please contact the Stinson LLP contact with whom you regularly work.